Exhibit 99.1

NYSE American: URG • TSX: URE 2019: The Year for Uranium

NYSE American: URG • TSX: URE This presentation contains “forward - looking statements,” within the meaning of applicable securities laws, regarding events or conditions that may occur in the future . Such statements include without limitation the Company’s maintaining controlled - level production operations and the ability to ramp up as planned with respect to timing and cost ; the technical and economic viability of Lost Creek ; whether the ongoing changes in the sector resemble 2004 - 2007 and may have the same effects ; ability to timely and cost - efficiently ramp up in response to changing market conditions, including time to build out Shirley Basin and to develop and permit Lost Soldier project for operations ; ability to complete additional favorable uranium sales agreements and to make use of purchases for delivery ; ability to further expand resources at the Lost Creek Property ; the further exploration, development and permitting of Company projects, including in the Great Divide Basin and Shirley Basin ; the technical and economic viability of Shirley Basin (including the production and cost projections contained in the preliminary economic analysis of the project) ; completion of (and timing for) regulatory approvals and other development at Shirley Basin and Lost Creek ; whether the expected increases in foreign state - subsidized imports of uranium occurs in coming years ; the expected further negative impacts of such imports on U . S . uranium production and national security ; whether the Section 232 filing with the Department of Commerce will proceed to a favorable recommendation and action taken by the President ; and whether certain prospective catalysts will occur and/or affect the market . These statements are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies . Numerous factors could cause actual events to differ materially from those in the forward - looking statements . Factors that could cause such differences, without limiting the generality of the following, include : risks inherent in exploration activities ; volatility and sensitivity to market prices for uranium ; volatility and sensitivity to capital market fluctuations ; the impact of exploration competition ; the ability to raise funds through private or public equity financings ; imprecision in resource and reserve estimates ; environmental and safety risks including increased regulatory burdens ; unexpected geological or hydrological conditions ; a possible deterioration in political support for nuclear energy ; changes in government regulations and policies, including trade laws and policies ; demand for nuclear power ; weather and other natural phenomena ; delays in obtaining or failures to obtain required governmental, environmental or other project approvals ; and other exploration, development, operating, financial market and regulatory risks . Although Ur - Energy Inc . believes that the assumptions inherent in the forward - looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this presentation . Ur - Energy Inc . disclaims any intention or obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise . Cautionary Note Regarding Projections : Similarly, t his presentation also may contain projections relating to an extended future period and, accordingly, the estimates and assumptions underlying the projections are inherently highly uncertain, based on events that have not taken place, and are subject to significant economic, financial, regulatory, competitive and other uncertainties and contingencies beyond the control of Ur - Energy Inc . Further, given the nature of the Company's business and industry that is subject to a number of significant risk factors, there can be no assurance that the projections can be or will be realized . It is probable that the actual results and outcomes will differ, possibly materially, from those projected . The attention of investors is drawn to the Risk Factors set out in the Company's Annual Report on Form 10 - K, filed March 1 , 2019 , which is filed with the U . S . Securities and Exchange Commission on EDGAR (http : //www . sec . gov/edgar . shtml) and the regulatory authorities in Canada on SEDAR (www . sedar . com) . Cautionary Note to U . S . Investors Concerning Estimates of Measured, Indicated or Inferred Resources : the information presented uses the terms "measured", "indicated" and "inferred" mineral resources . United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms . United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves . United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally minable . James A Bonner, Ur - Energy Vice President, Geology, P . Geo . , and Qualified Person as defined by NI 43 - 101 , reviewed and approved the technical information contained in this presentation . 2

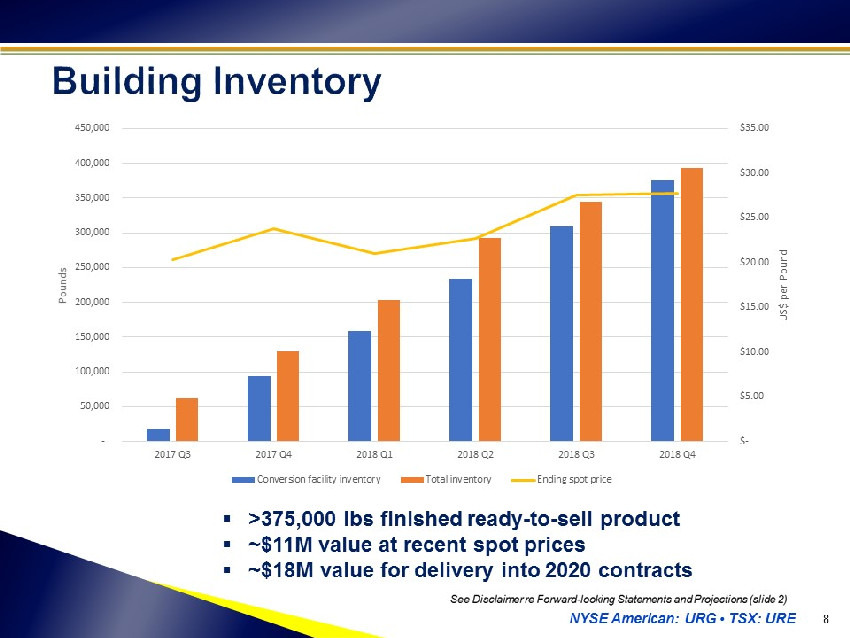

NYSE American: URG • TSX: URE 3 See Disclaimer re Forward - looking Statements and Projections (slide 2) ▪ Lost Creek ISR Uranium Facility • 5+ years of consistent production • Produced ~2.7M lbs. U 3 0 8 through 2018 • Controlled production at market - appropriate levels • Lowest - cost producer among publicly - traded companies ▪ Flexibility and value realized through higher - priced term contracts • 2013 - 2018 deliveries to customers: 2.2Mlbs Lost Creek production + 1.2Mlbs purchased product • Consistency of cashflow - best profit margins (2019 projected at $11.5M in gross profits) • Growing inventory in rising market – all current production going into finished product inventory; current inventory of finished product, ~$11M value at recent spot pricing ($18M for 2020 deliveries) ▪ Forging a path forward for the U.S. domestic uranium industry • Determination and remedy on Section 232 investigation into effects of uranium imports on national security could dramatically affect the future of U.S. uranium production • URG has maintained operational readiness to react to changing market fundamentals; Q3 equity financing maintains readiness to ramp up

NYSE American: URG • TSX: URE 4 ▪ Improved safety record year over year ▪ Produced, packaged and shipped ~2.5M lbs U 3 O 8 ▪ Built solid contract book for a period of nine years (2013 - 2021) ▪ Significantly grew Lost Creek Property NI 43 - 101 resource ▪ First ISR facility to reduce/recycle waste water using Class V UIC water disposal systems ▪ 92% recovery of under - pattern MU1 resources, and still going ▪ Two mine units currently permitted for additional development and operations with nearly 4.5M lbs U 3 O 8 estimated ▪ 10 additional mine units planned in NI 43 - 101 Lost Creek PEA ▪ LC East permit amendment progressing (FEIS published) See Amended Preliminary Economic Assessment for the Lost Creek Property, Sweetwater County, Wyoming, 2/8/2016 (filed on SEDAR) See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE 5 Staffing ▪ Key personnel retained to lead ramp - up Wellfield ▪ MU1: ▪ Recovered ∼ 92% of under - pattern resources ▪ Planning for capture of remaining pounds not currently under pattern ▪ MU2 ▪ Recovered ∼ 65% of under - pattern resources in first three header houses ▪ Remainder of unit is “drill, construction & production ready” ▪ 10 additional mine units Processing Plant ▪ Focus on optimizing processes for full production rate ▪ Waste Water ▪ Class V UIC water disposal / recycling systems in - place ▪ Class I UIC disposal wells utilized as necessary See Disclaimer re Forward - looking Statements and Projections (slide 2)

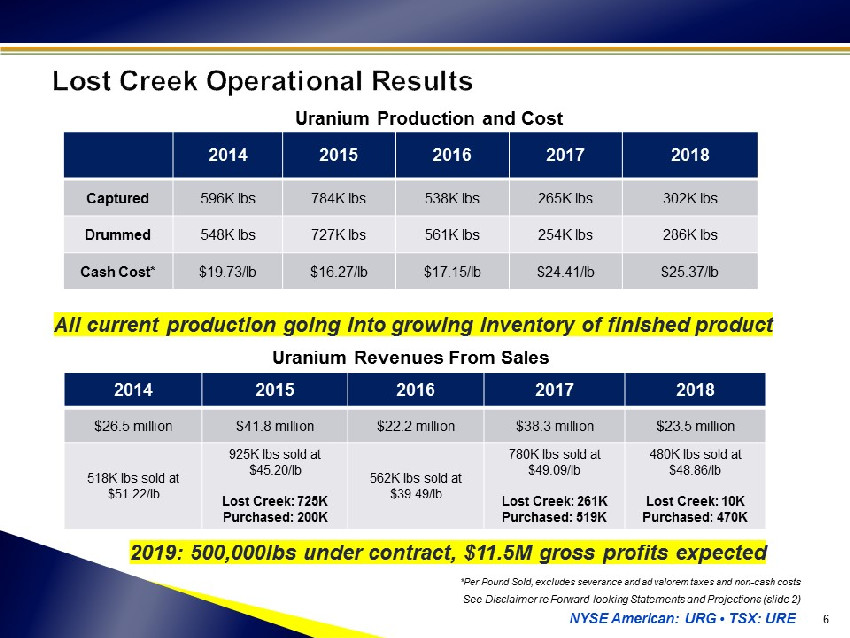

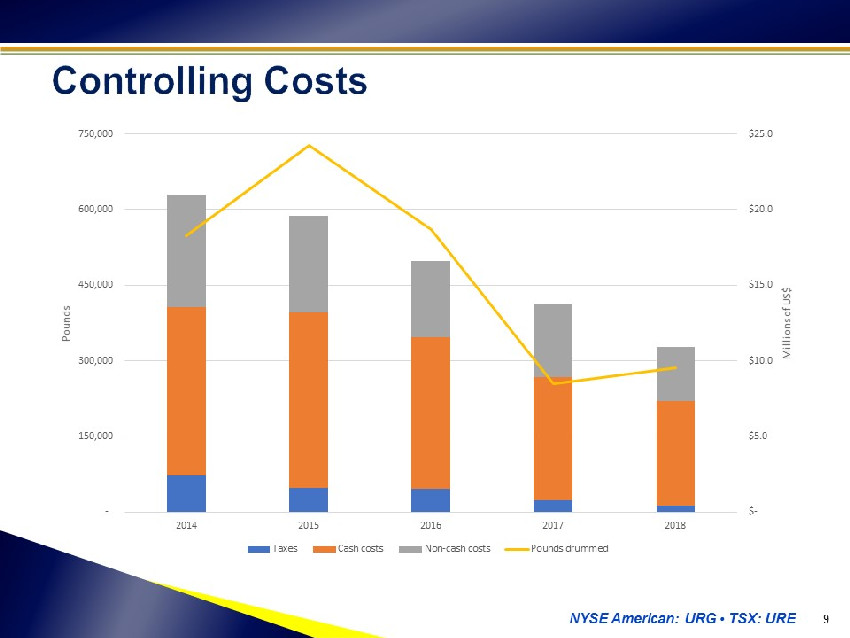

NYSE American: URG • TSX: URE 6 2014 2015 2016 2017 2018 Captured 596K lbs 784K lbs 538K lbs 265K lbs 302K lbs Drummed 548K lbs 727K lbs 561K lbs 254K lbs 286K lbs Cash Cost* $19.73/lb $16.27/lb $17.15/lb $24.41/lb $25.37/ lb Uranium Production and Cost 2014 2015 2016 2017 2018 $26.5 million $41.8 million $22.2 million $38.3 million $23.5 million 518K lbs sold at $51.22/lb 925K lbs sold at $45.20/lb Lost Creek: 725K Purchased: 200K 562K lbs sold at $39.49/lb 780K lbs sold at $49.09/lb Lost Creek: 261K Purchased: 519K 480K lbs sold at $48.86/lb Lost Creek: 10K Purchased: 470K Uranium Revenues From Sales *Per Pound Sold, excludes severance and ad valorem taxes and non - cash costs See Disclaimer re Forward - looking Statements and Projections (slide 2) All current production going into growing inventory of finished product 2019: 500,000lbs under contract, $11.5M gross profits expected

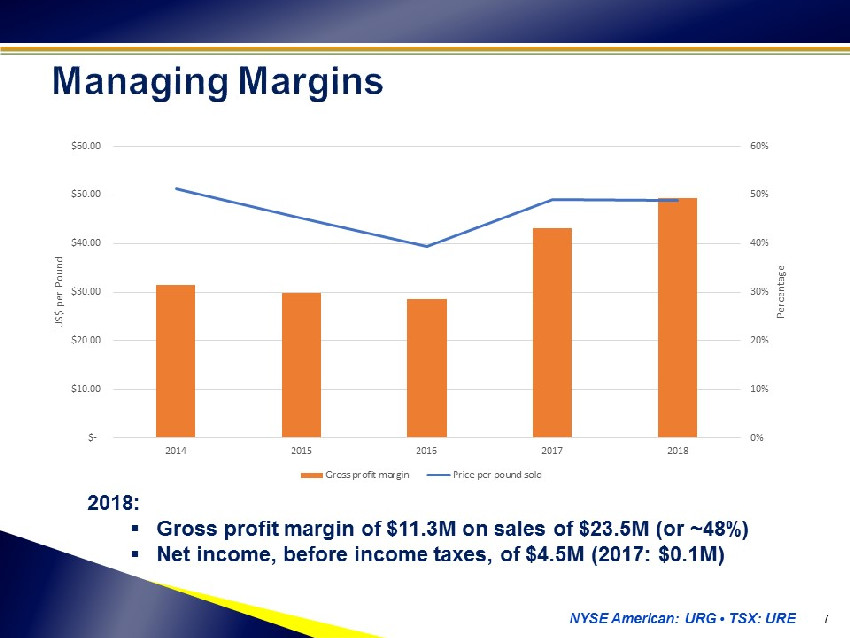

NYSE American: URG • TSX: URE 7 0% 10% 20% 30% 40% 50% 60% $- $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 2014 2015 2016 2017 2018 Percentage US$ per Pound Gross profit margin Price per pound sold 2018: ▪ Gross profit margin of $11.3M on sales of $23.5M (or ~48%) ▪ Net income, before income taxes, of $4.5M (2017: $0.1M)

NYSE American: URG • TSX: URE 8 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 2017 Q3 2017 Q4 2018 Q1 2018 Q2 2018 Q3 2018 Q4 US$ per Pound Pounds Conversion facility inventory Total inventory Ending spot price ▪ >375,000 lbs finished ready - to - sell product ▪ ~$11M value at recent spot prices ▪ ~$18M value for delivery into 2020 contracts

NYSE American: URG • TSX: URE 9 $- $5.0 $10.0 $15.0 $20.0 $25.0 - 150,000 300,000 450,000 600,000 750,000 2014 2015 2016 2017 2018 Millions of US$ Pounds Taxes Cash costs Non-cash costs Pounds drummed

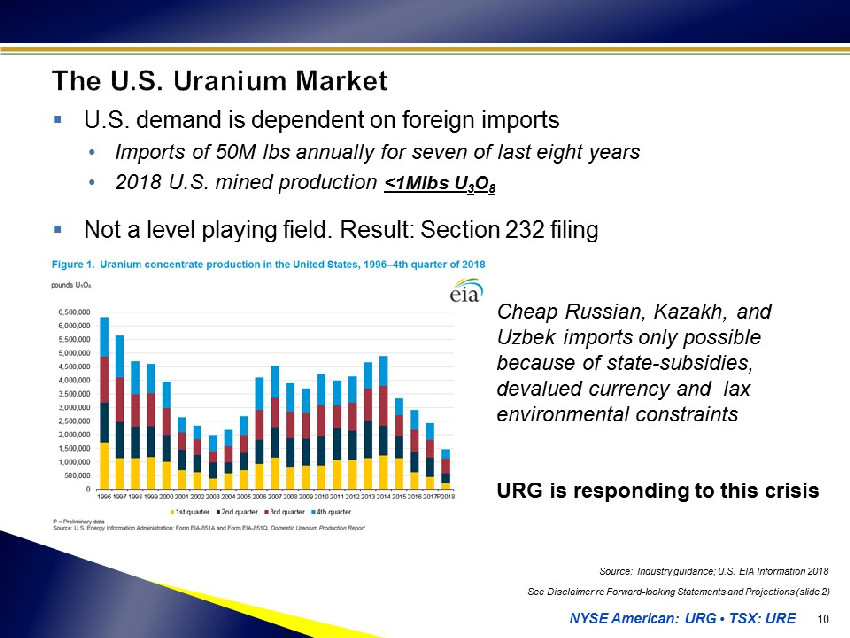

NYSE American: URG • TSX: URE ▪ U.S. demand is dependent on foreign imports • Imports of 50M lbs annually for seven of last eight years • 2018 U.S. mined production <1Mlbs U 3 O 8 ▪ Not a level playing field. Result: Section 232 filing 10 See Disclaimer re Forward - looking Statements and Projections (slide 2) Source: Industry guidance; U.S. EIA Information 2018 Cheap Russian, Kazakh, and Uzbek imports only possible because of state - subsidies, devalued currency and lax environmental constraints URG is responding to this crisis

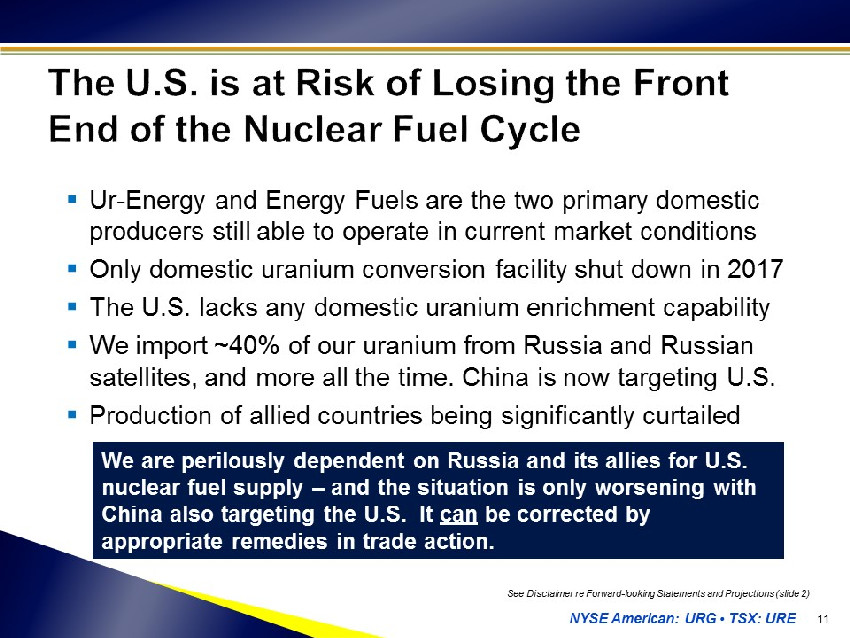

NYSE American: URG • TSX: URE 11 ▪ Ur - Energy and Energy Fuels are the two primary domestic producers still able to operate in current market conditions ▪ Only domestic uranium conversion facility shut down in 2017 ▪ The U.S. lacks any domestic uranium enrichment capability ▪ We import ~40% of our uranium from Russia and Russian satellites, and more all the time. China is now targeting U.S. ▪ Production of allied countries being significantly curtailed See Disclaimer re Forward - looking Statements and Projections (slide 2) We are perilously dependent on Russia and its allies for U.S. nuclear fuel supply – and the situation is only worsening with China also targeting the U.S. It can be corrected by appropriate remedies in trade action.

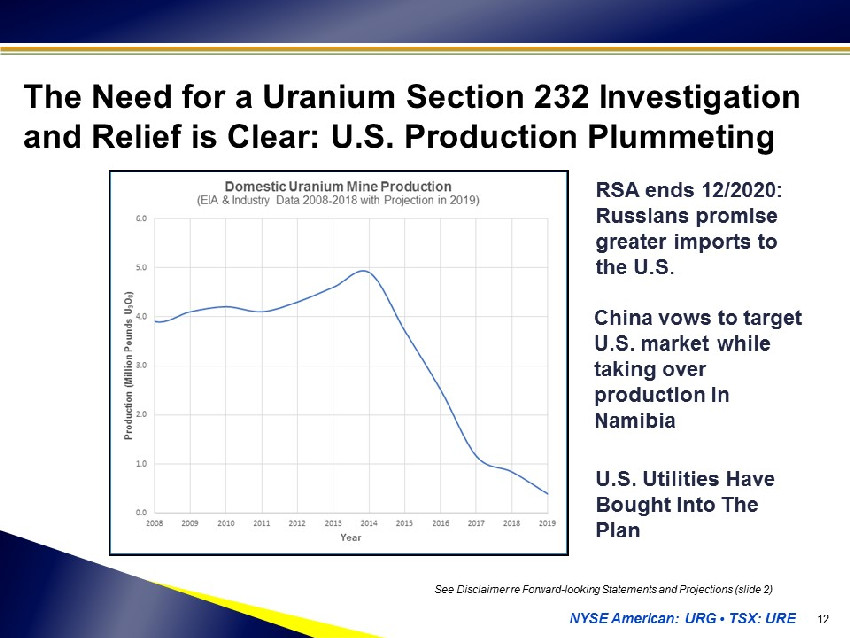

NYSE American: URG • TSX: URE 12 RSA ends 12/2020: Russians promise greater imports to the U.S. The Need for a Uranium Section 232 Investigation and Relief is Clear: U.S. Production Plummeting China vows to target U.S. market while taking over production in Namibia U.S. Utilities Have Bought Into The Plan See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Military needs, by treaty, must be filled with domestic supply yet our inventory is, in the words of DOE, “finite and diminishing . ” Tritium Naval Propulsion Weapons Priority Missions ▪ National economic security is also an integral part of the statute . U . S . nuclear utilities produce 20 % of our nation’s electricity and get upwards of 40 % of their fuel from Russia and its allies . We expect that percentage to increase as Canadian production falls . ▪ We are losing our seat at the non - proliferation table. Remedy for National Security and to Sustain the Industry ▪ Quota reserving 25% of U.S. market to domestic producers ▪ Buy American 13 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE x Petition filed January 16, 2018 x Commerce initiated the investigation on July 18, 2018 x Public comment period ends September 10, 2018 ▪ Commerce must complete its investigation within 270 days and make recommendations to the President (April 14, 2019) ▪ The President then has up to 90 days to accept Commerce’s recommendations or substitute his own judgment ▪ The process will be complete no later than July 15, 2019 ▪ Remedies would likely take effect immediately, per statute 14 See Disclaimer re Forward - looking Statements and Projections (slide 2)

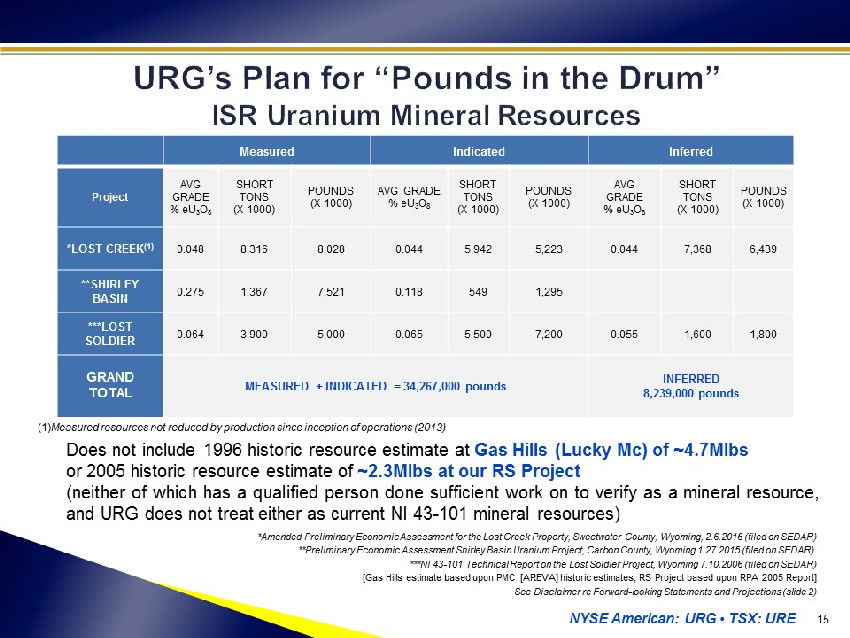

NYSE American: URG • TSX: URE Measured Indicated Inferred Project AVG GRADE % eU 3 O 8 SHORT TONS (X 1000) POUNDS (X 1000) AVG GRADE % eU 3 O 8 SHORT TONS (X 1000) POUNDS (X 1000) AVG GRADE % eU 3 O 8 SHORT TONS (X 1000) POUNDS (X 1000) *LOST CREEK (1) 0.048 8,316 8,028 0.044 5,942 5,223 0.044 7,368 6,439 **SHIRLEY BASIN 0.275 1,367 7,521 0.118 549 1,295 ***LOST SOLDIER 0.064 3,900 5,000 0.065 5,500 7,200 0.055 1,600 1,800 GRAND TOTAL MEASURED + INDICATED = 34,267,000 pounds INFERRED 8,239,000 pounds 15 (1) Measured resources not reduced by production since inception of operations (2013) Does not include 1996 historic resource estimate at Gas Hills (Lucky Mc) of ~ 4 . 7 Mlbs or 2005 historic resource estimate of ~ 2 . 3 Mlbs at our RS Project (neither of which has a qualified person done sufficient work on to verify as a mineral resource, and URG does not treat either as current NI 43 - 101 mineral resources) *Amended Preliminary Economic Assessment for the Lost Creek Property, Sweetwater County, Wyoming, 2.6.2016 (filed on SEDAR) **Preliminary Economic Assessment Shirley Basin Uranium Project, Carbon County, Wyoming 1.27.2015 (filed on SEDAR). ***NI 43 - 101 Technical Report on the Lost Soldier Project, Wyoming 7.10.2006 (filed on SEDAR) [Gas Hills estimate based upon PMC [AREVA] historic estimates; RS Project based upon RPA 2005 Report] See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE 16 ▪ Production ▪ Planning for capture of remaining MU1 pounds not currently under pattern ▪ 10 remaining mine units at Lost Creek, per 2016 PEA; est. 4.5Mlbs remaining in MUs1&2 (fully permitted) ▪ Efficiencies ▪ Operating staff only; retained key staff for ramp - up ▪ Optimized Class V waste water recycling ▪ Modified production systems to enhance / stabilize flowrates; optimized recovery curve Inside Lost Creek MU2 Header House Q3 2018 Financing Further Facilitates URG Operational Leverage See Disclaimer re Forward - looking Statements and Projections (slide 2)

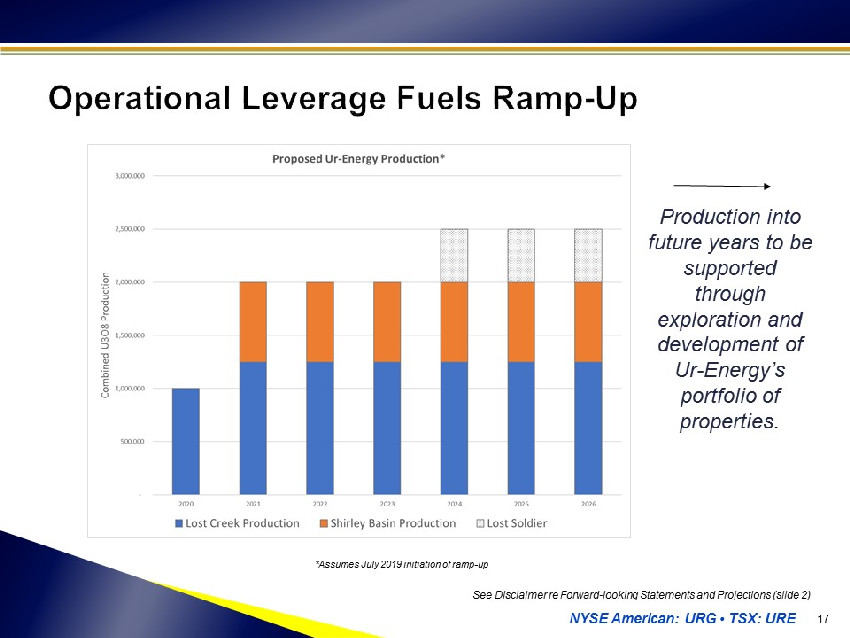

NYSE American: URG • TSX: URE 17 *Assumes July 2019 initiation of ramp - up Production into future years to be supported through exploration and development of Ur - Energy’s portfolio of properties . See Disclaimer re Forward - looking Statements and Projections (slide 2)

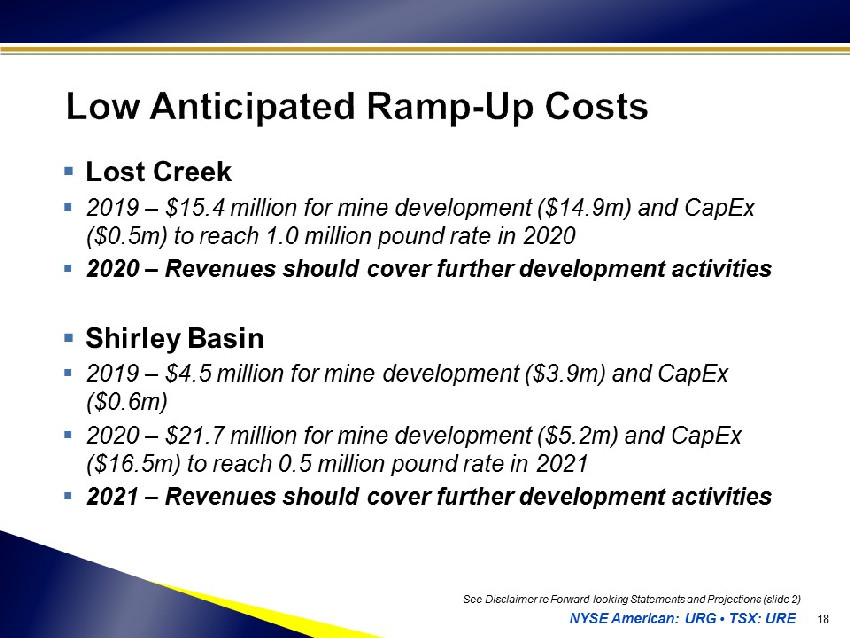

NYSE American: URG • TSX: URE ▪ Lost Creek ▪ 2019 – $15.4 million for mine development ($14.9m) and CapEx ($0.5m) to reach 1.0 million pound rate in 2020 ▪ 2020 – Revenues should cover further development activities ▪ Shirley Basin ▪ 2019 – $4.5 million for mine development ($3.9m) and CapEx ($0.6m) ▪ 2020 – $21.7 million for mine development ($5.2m) and CapEx ($16.5m) to reach 0.5 million pound rate in 2021 ▪ 2021 – Revenues should cover further development activities 18 See Disclaimer re Forward - looking Statements and Projections (slide 2)

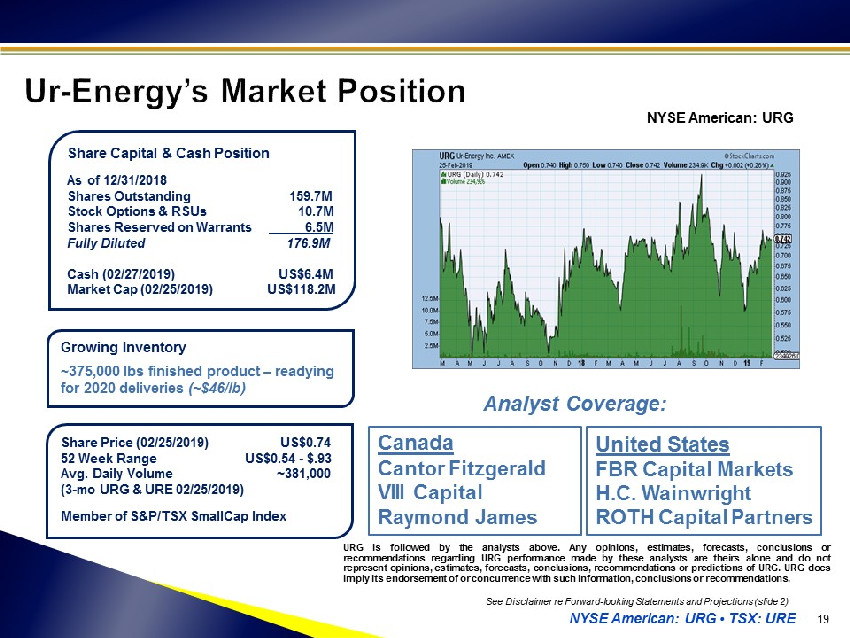

NYSE American: URG • TSX: URE 19 Share Price (02/25/2019) US$0.74 52 Week Range US$0.54 - $.93 Avg. Daily Volume ~381,000 (3 - mo URG & URE 02/25/2019) Member of S&P/TSX SmallCap Index Share Capital & Cash Position As of 12/31/2018 Shares Outstanding 159.7M Stock Options & RSUs 10.7M Shares Reserved on Warrants 6.5M Fully Diluted 176.9M Cash (02/27/2019) US$6.4M Market Cap (02/25/2019) US$118.2M NYSE American: URG Canada Cantor Fitzgerald VIII Capital Raymond James United States FBR Capital Markets H.C. Wainwright ROTH Capital Partners Analyst Coverage: URG is followed by the analysts above . Any opinions, estimates, forecasts, conclusions or recommendations regarding URG performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts, conclusions, recommendations or predictions of URG . URG does imply its endorsement of or concurrence with such information, conclusions or recommendations . Growing Inventory ~375,000 lbs finished product – readying for 2020 deliveries (~$46/ lb ) See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Supply / Demand: Growth Rate is Real • New players entering uranium market • Real production cuts from Kazakhstan and Cameco ▪ Current Market Forces • Cameco in market as buyer • Section 232 investigation progressing - potential for increased market for U.S. producers ▪ Geopolitical Risks • U.S. facing conflicts and uncertainty in multiple regions around the globe • Heavy dependence upon low - cost imports from Russia, Kazakhstan, and Uzbekistan increases potential for significant supply disruption • Chinese tariffs already in place 20 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE • Recent capital raise + term contracts = well financed for 2019 500,000 lbs for 2019 deliveries – expect $11.5M gross profits • Current value of term contracts – use of purchased pounds All production currently going into growing inventory Finished product being readied for 2020 contracts • Lowest cash cost producer / cash flow positive Resulting operating leverage • Low ramp - up costs to attain 2Mlb runrate from large, scalable resources Numerous funding alternatives (revenues, bonding, strategic investment partner) Better positioned with lower ramp - up costs than other operators 21 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE Q&A Session Your questions, please 22

NYSE American: URG • TSX: URE For more information, please contact: Jeff Klenda , Chairman, President & CEO By Mail: Ur - Energy Inc. 10758 W. Centennial Rd., Suite 200 Littleton, CO 80127 USA By Phone: Office 720.981.4588 Toll - Free 866.981.4588 Fax 720.981.5643 By E - mail: jeff.klenda@ur - energy.com 23