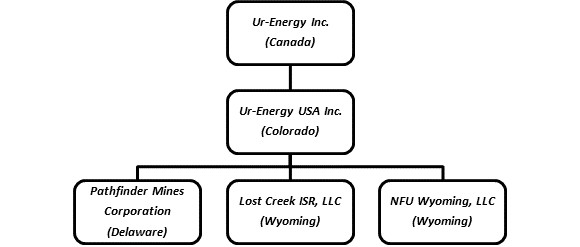

Currently, and at December 31, 2024, our principal direct and indirect subsidiaries, and affiliated entities, and the jurisdictions in which they were incorporated or organized, are as follows:

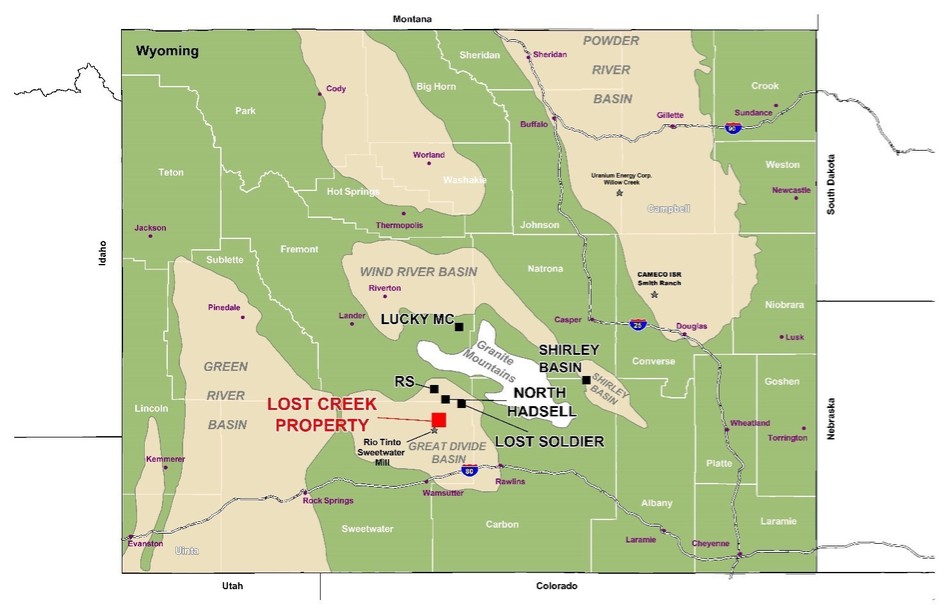

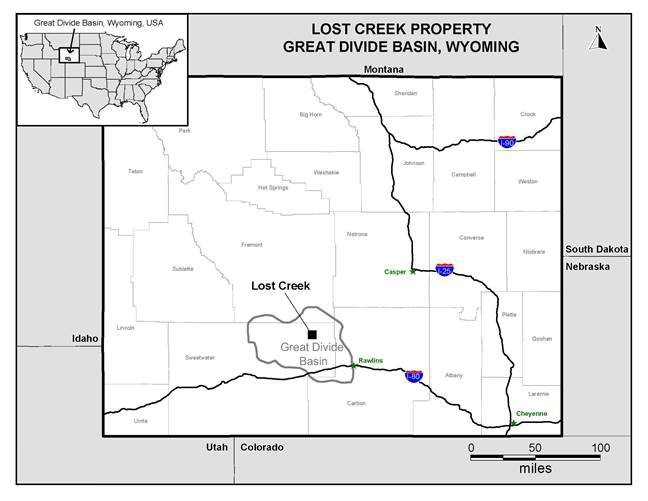

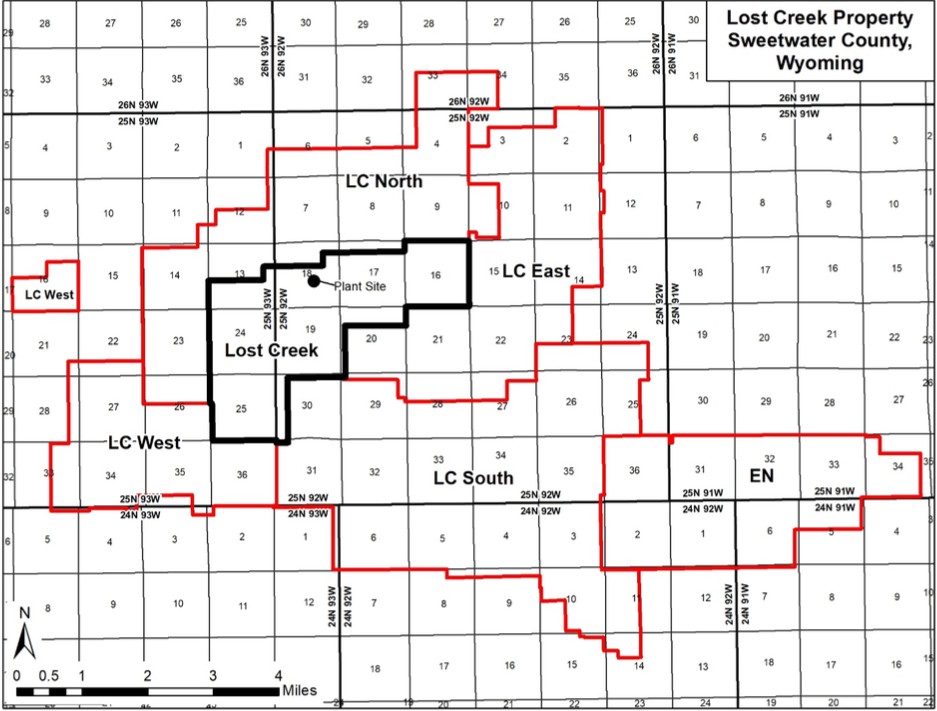

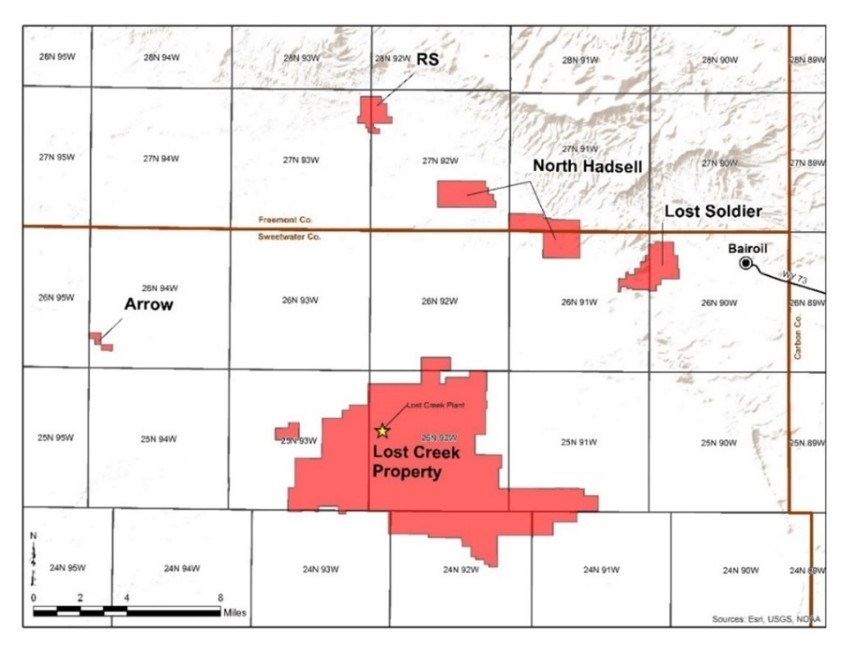

Our wholly owned Lost Creek Project in Sweetwater County, Wyoming is our flagship first property. The project has been fully permitted and licensed since October 2012. We received operational approval from the U.S. Nuclear Regulatory Commission (“NRC”) and started production operation activities in August 2013. Our first sales of Lost Creek production were made in December 2013.

From commencement of operations until 2020, we had multiple term uranium sales agreements in place with U.S. utilities for the sale of Lost Creek production or other yellowcake product at contracted pricing. We completed our initial sales contracts in 2020 when we sold 200,000 pounds of Uranium Oxide (“U3O8”). We did not make any sales of U3O8 inventory in 2021 – 2022.

We sold 100,000 pounds U3O8 to the U.S. Department of Energy (“DOE”) National Nuclear Security Administration (“NNSA”) in January 2023, as a part of the national uranium reserve program. In 2023, we delivered 180,000 pounds U3O8 into one of our sales agreements, for a total of 280,000 pounds U3O8 sold in 2023 for proceeds of $17.3 million. In 2024, we delivered 570,000 pounds U3O8 into two of our sales agreements for proceeds of $33.1 million.

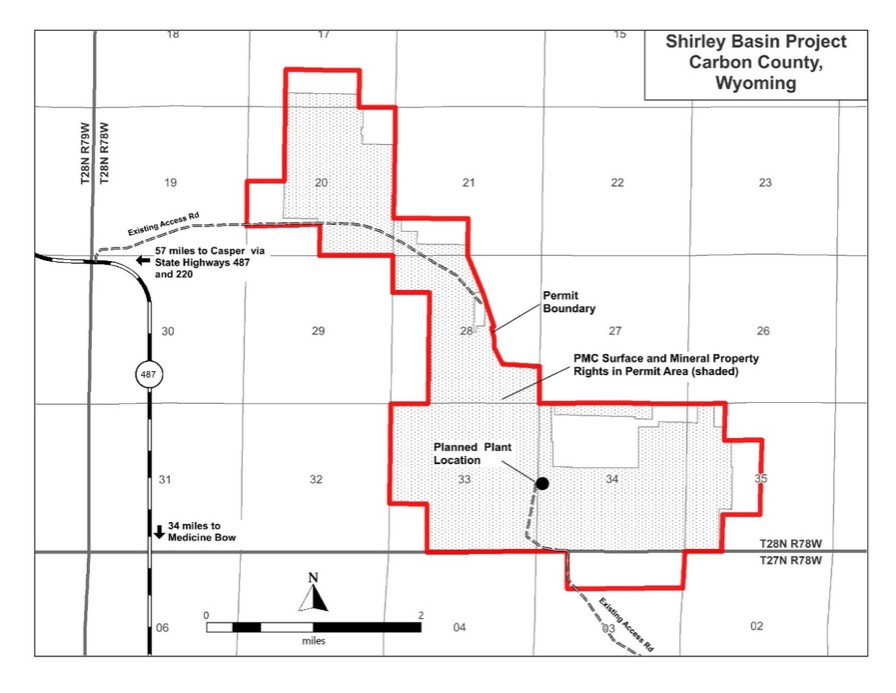

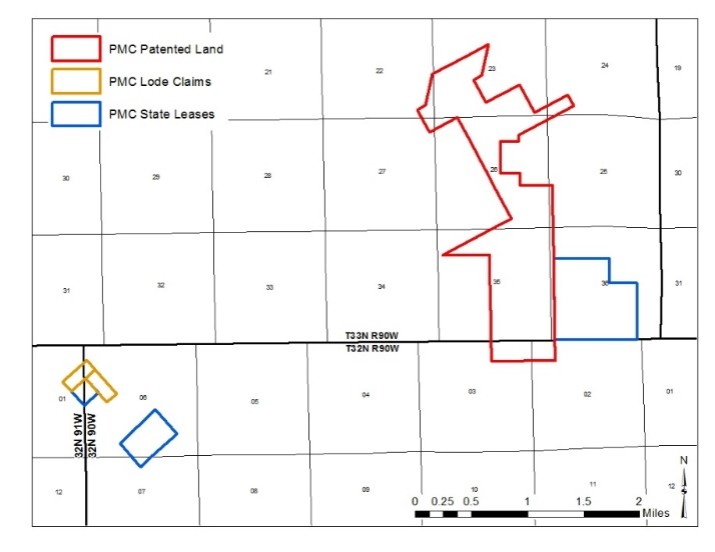

Shirley Basin, our other material property, and second flagship property, is one of the assets we acquired as a part of the Pathfinder acquisition in 2013. We also acquired all the historic geologic and engineering data for the project. During 2014, we completed a drill program of a limited number of confirmatory holes to complete an NI 43-101 mineral resource estimate which was released in August 2014; subsequently, an NI 43-101 Preliminary Economic Assessment for Shirley Basin was completed in January 2015. See also “Shirley Basin ISR Uranium Project S-K 1300 Report,” below. Baseline studies necessary for the permitting and licensing of the project commenced in 2014 and were completed in 2015.

In December 2015, our applications for a permit and license to mine at Shirley Basin was submitted to the State of Wyoming Department of Environmental Quality (“WDEQ”). The Wyoming Uranium Recovery Program (“URP”) issued our source material license and the Land Quality Division (“LQD”) issued the permit to mine for Shirley Basin in 2021. We received approvals for the project from the U.S. Bureau of Land Management (“BLM”) in 2020. Therefore, all major authorizations to construct and operate at Shirley Basin have been received. We have begun construction and development at the site, with construction of the satellite plant planned in 2025. We anticipate production will begin at Shirley Basin in Q1 2026.

We currently have seven multi-year sales agreements for delivery of a base quantity ranging between 440,000 and 1,300,000 pounds U3O8 annually from 2025 through 2030. Our agreements also provide for smaller 100,000-pound annual deliveries in 2032 and 2033.

10